Hurco Companies reports Q2 EPS (62c) vs. (61c) last year

Q2 Revenue Decline: Hurco reported a Q2 revenue of $40.9 million, down from $45.2 million the previous year, amid significant uncertainty in global markets affecting sales forecasting.

Commitment to Strategy and Development: CEO Greg Volovic emphasized the company's focus on strengthening cash flow, reducing costs, and continuing investment in product development to adapt to market demands and aim for profitability.

Trade with 70% Backtested Accuracy

Analyst Views on HURC

About HURC

About the author

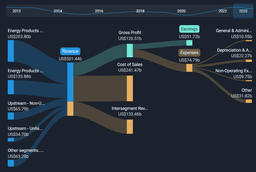

- Financial Performance Decline: Hurco reported a net loss of $15.1 million for fiscal year 2025, translating to a diluted loss per share of $2.34, which, while an improvement from the $16.6 million loss in fiscal 2024, still indicates ongoing financial challenges.

- Sales Revenue Drop: The company generated $178.6 million in sales and service fees for fiscal 2025, a 4% decrease year-over-year, primarily driven by declining sales in the Americas and Europe, reflecting a trend of weakened market demand.

- Order Volume Decrease: New orders totaled $171.3 million for fiscal 2025, down 14% from the previous year, with a 10% decline in the Americas and an 18% drop in Europe, highlighting a significant reduction in customer demand.

- Cost Control Measures: Despite the sales downturn, Hurco managed to reduce selling, general, and administrative expenses by nearly $3 million, increasing cash flow to $48.7 million, demonstrating the company's ability to maintain financial stability amid adversity.

- Financial Performance Decline: Hurco reported a net loss of $15.1 million for fiscal year 2025, translating to a diluted loss of $2.34 per share, which, while an improvement from the $16.6 million loss in fiscal 2024, still indicates ongoing financial challenges.

- Sales Revenue Drop: The company's sales and service fees totaled $178.6 million for fiscal year 2025, a 4% decrease year-over-year, primarily driven by reduced orders in the U.S. and European markets, reflecting a trend of overall weak demand.

- Poor Order Situation: New orders for fiscal year 2025 amounted to $171.3 million, down 14% from the previous year, with a staggering 39% decline in the Asia Pacific region, highlighting a significant drop in market demand, particularly in China and India.

- Cost Control Measures: Despite the sales decline, Hurco managed to reduce selling, general, and administrative expenses by nearly $3 million, demonstrating its ability to maintain cost control in adversity and laying the groundwork for future recovery.

Market Performance: In Q3 2025, small-cap stocks rose over 12% according to the Russell 2000 Index, but Diamond Hill Capital's Small Cap Strategy portfolio underperformed with a return of 7.93% due to missing out on sectors driving the rally.

Hurco Companies, Inc.: The portfolio included Hurco Companies, Inc. (NASDAQ:HURC), which saw a one-month return of -7.99% and a 52-week decline of 29.91%. Despite its potential, the firm believes other AI stocks present better investment opportunities.

Investment Strategy: The investor letter noted challenges in finding new investment ideas due to rising valuations, leading to the initiation of a position in Hurco Companies, Inc. during Q3.

Hedge Fund Interest: Hurco Companies, Inc. was held by six hedge fund portfolios at the end of Q2 2025, maintaining the same level of interest as the previous quarter, but it is not among the most popular stocks among hedge funds.

Retirement Announcement: Michael Doar, Executive Chairman of Hurco Companies, Inc., will retire after the 2026 Annual Meeting but has been nominated to continue as a non-executive director and Chairman of the Board.

Tenure and Contributions: Doar has been with Hurco since 2000, serving as CEO for 20 years, and has played a significant role in the company's growth and relationships within the manufacturing industry.

Leadership Transition: Current CEO Greg Volovic and CFO Sonja McClelland will continue to lead the company, with a commitment to uphold the values and legacy established by Doar during his tenure.

Company Overview: Hurco is an international technology company specializing in CNC machine tools, serving various industries including aerospace and medical equipment, with operations and sales across multiple countries.

Hurco's Financial Performance: Hurco Companies, Inc. reported a net loss of $3.7 million for Q3 2025, an improvement from a $9.6 million loss the previous year, with revenue increasing by 7.4% to $45.8 million, driven by strong sales in the Americas and Asia Pacific.

Market Trends and Challenges: Despite revenue growth, new orders fell 22.4% year-over-year, indicating macroeconomic caution, particularly in Europe and China, while the company maintains a strong cash position of $44.5 million and plans for future share repurchases and potential dividend reinstatement.

Financial Performance: Hurco Companies reported a revenue of US$45.8 million, a 7.4% increase from the previous quarter, while net loss narrowed to US$3.69 million, improving loss per share from US$1.47 to US$0.57.

Market Insights: Shares of Hurco Companies have risen by 7.5% over the past week, and there is a warning sign identified regarding the company, alongside a mention of potential benefits from Trump's oil and gas policies for certain US stocks.