HSI Rises 267 Points at Midday; BABA-W and BIDU-SW Top Performers; WUXI APPTEC Jumps 6%

US-China Economic Consensus: A preliminary agreement between China and the US on economic and trade issues boosted Hong Kong stocks, with the Hang Seng Index rising 267 points to close at 26,427.

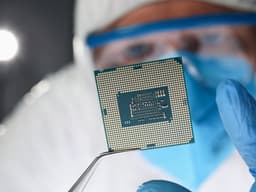

AI and Chip Stocks Surge: Stocks related to AI and semiconductors saw significant gains, with notable increases in companies like Alibaba, Baidu, and SMIC, reflecting strong market interest.

Automotive Market Outlook: The China Passenger Car Association reported reduced inventory pressure for passenger cars, predicting robust sales for manufacturers like BYD and NIO, which also saw their stock prices rise.

Pharmaceutical Sector Performance: Wuxi Apptec reported an 85% profit increase for the first three quarters, leading to a 6% surge in its stock price, while other pharmaceutical stocks also experienced gains.

Trade with 70% Backtested Accuracy

Analyst Views on 00522

About the author

Market Decline: Hong Kong stocks experienced significant losses, with the HSI dropping 611 points (2.2%) to close at 26,775, influenced by a volatile commodity market and declining resource stocks.

Precious Metals and Resource Stocks: Gold and silver prices fell sharply, with major companies like SD GOLD and ZHAOJIN MINING seeing declines of over 8%, while resource stocks like JIANGXI COPPER and CHALCO also reported significant losses.

Telecom Sector Impact: Telecom companies faced declines due to an increase in VAT from 6% to 9%, with CHINA UNICOM and CHINA TELECOM dropping over 6%, and CHINA MOBILE falling by 2.3%.

Automotive and Chip Sector Struggles: Automakers reported substantial sales declines, with BYD COMPANY and XPENG-W experiencing drops of 30% YoY and 34% YoY respectively, while the chip sector also faced losses, particularly for SMIC and HUA HONG SEMI.

Hong Kong Stock Market Performance: Hong Kong stocks saw significant gains, with the HSI rising 1.4% to close at 27,126, and total market turnover reaching $254.373 billion.

Financial Sector Gains: Major financial stocks like HSBC, HKEX, and AIA experienced notable increases, with HSBC up 2.7% and AIA jumping 4.1%.

Chinese Banks and Insurers: Chinese banks and insurers also reported gains, with CITIC BANK and CHINA LIFE rising 3.3% and 6% respectively, reflecting positive market sentiment.

AI and Tech Stocks Surge: AI-related stocks surged following new product launches, with companies like BABA-W and KINGSOFT CLOUD seeing significant increases in share prices, driven by advancements in AI technology.

Market Performance: The HSI rose by 119 points (0.45%) to close at 26,749, with the HSCEI and HSTECH also showing gains, while total market turnover reached HKD240.872 billion.

Tech Stock Movements: BABA-W advanced 2.2% amid news of supporting its chip subsidiary's independent listing, while other tech stocks like TENCENT and NTES-S saw slight declines, and KUAISHOU-W and BILIBILI-W experienced notable increases.

Chip Sector Developments: The acceptance of Enflame's IPO application on China's STAR Market positively impacted chip stocks, with SMIC and HUA HONG SEMI gaining, while INNOSCIENCE and BIREN TECH faced declines.

Renewable Energy Stocks Surge: Following Elon Musk's support for space photovoltaics, companies like GCL TECH, FLAT GLASS, and XINYI SOLAR saw significant stock price increases, with gains ranging from 9.3% to 11.1%.

Market Performance: The HSI rose 0.33% to 26,718, with total half-day turnover reaching $127.938 billion, while the HSCEI and HSTECH also saw slight increases.

BABA-W Support: Alibaba's share price increased by 2.6% after rumors of supporting its chip subsidiary's separate listing, coinciding with the acceptance of Enflame's IPO application.

Sector Movements: Chip stocks experienced declines, with notable drops in SMIC and HUA HONG SEMI, while financials showed mixed results, with HSBC sliding slightly and HKEX gaining.

Stock Highlights: BYD and robotics stocks like JOHNSON ELEC faced losses, while XIAOMI surged 2.5% following a share buyback announcement, and POP MART's new product launch boosted its shares by 6.5%.

Market Performance: The HSI closed up 44 points (0.17%) at 26,629, while the HSCEI fell 8 points (0.1%) to 9,114. The HSTECH rose 16 points (0.28%) to 5,762, with a total market turnover of HKD234.86 billion.

Chip Stocks Rally: Following a rally in memory chip stocks, ASMPT surged 6.3% to HKD108.2, while other chip makers like SMIC and HUA HONG SEMI also saw gains, reflecting positive sentiment in the sector.

Tech Stock Movements: BIDU-SW increased by 4.1% after JPMorgan raised its target price, while TENCENT and MEITUAN-W dipped slightly. BABA-W and JD-SW experienced modest gains.

Automotive and AI Stocks: BYD edged up 0.7%, while XPENG and SERES saw declines. AI stocks like UNISOUND and FOURTH PARADIGM dropped significantly, indicating volatility in the tech and automotive sectors.

Market Performance: The HSI fell 0.1% to 26,558, while the HSCEI and HSTECH also experienced declines of 0.3% and 0.4%, respectively, with a total half-day turnover of $131.628 billion.

Chip Stocks Surge: External memory chip stocks saw significant gains, with Disco hitting the day limit and ASMPT rising 6%, while other chip stocks like HUA HONG SEMI and INNOSCIENCE also posted positive performances.

Tech Stock Movements: KINGDEE INT'L surged 3.2% on profit expectations, while BIDU-SW rose 4.2% after positive forecasts from JPMorgan; however, major players like TENCENT and MEITUAN-W saw slight declines.

Economic Indicators: China's unemployment rate remained stable at 5.1%, and the Loan Prime Rate for January 2026 was unchanged at 3.00%, aligning with forecasts.