Fresenius Medical Care Reports Increased Q3 Results and Reaffirms FY25 Forecast

Financial Performance: Fresenius Medical Care reported a 29% increase in net income to 275 million euros in Q3, with adjusted net income growing 36% to 322 million euros. Basic earnings per share rose to 0.94 euros from 0.73 euros.

Revenue Growth: The company's revenue for the third quarter increased by 3% to 4.89 billion euros, with an 8% rise at constant currency and a 10% organic growth across all operating segments.

Future Outlook: Fresenius Medical Care confirmed its fiscal 2025 outlook, expecting positive revenue growth at constant currency in the low-single digits and operating income growth in the high-teens to high-twenties percent range.

Cost Savings Program: The company anticipates full-year FME25+ savings to reach 1.05 billion euros by the end of 2027, with associated program costs estimated between 1 billion euros and 1.05 billion euros during the same period.

Trade with 70% Backtested Accuracy

Analyst Views on FMS

About FMS

About the author

- Glaukos Sales Projection: Glaukos Corp anticipates FY25 sales of $507 million, yet its shares fell 12.1% in pre-market trading, indicating market concerns about its growth outlook despite the positive sales forecast.

- Briacell's Sharp Decline: Briacell Therapeutics' announcement of a $30 million public offering led to a staggering 53.1% drop in its stock price during pre-market trading, reflecting investor apprehension regarding the financing strategy.

- Trip.com Investigation Impact: Trip.com Group confirmed it is under investigation by China's SAMR for potential anti-monopoly violations, resulting in a 9.3% decline in its pre-market stock price, which may adversely affect its market performance and investor confidence.

- Pearson Trading Update: Pearson PLC's trading update for 2025 caused its shares to drop 7.2% in pre-market trading, indicating a cautious market sentiment regarding its future performance.

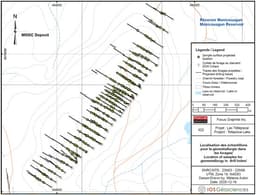

- Technological Innovation: Focus Graphite has successfully developed and validated a low-cost AI-enabled in situ graphite flake size characterization technology, directly integrated into the geometallurgical model of the Lac Tetepisca Project, thereby enhancing resource valuation accuracy and mining planning efficiency.

- Economic Benefits: Preliminary results indicate an inverse relationship between graphite grade and flake size, supporting the potential for a lower cut-off grade, which is expected to positively impact project economics, particularly in the upcoming mineral resource estimate.

- Sample Processing Progress: Approximately 300 samples are currently being processed to support the mineral resource estimate update anticipated in Q1 2026, ensuring the effectiveness and reliability of the new technology.

- Sustainability Strategy: The application of this technology not only enhances selective mining but also complements Focus's ESG initiatives by promoting low-emission, chemical-free purification technologies, ensuring a sustainable supply chain from mine to market.

- Continuation of Buyback Program: Fresenius Medical Care announced the continuation of its €1 billion share buyback program, with the second tranche targeting approximately €415 million from January 12 to May 8, aimed at enhancing shareholder value and boosting market confidence.

- Successful Completion of First Tranche: The first tranche was completed ahead of schedule on December 29, demonstrating the company's confidence in its stock value and laying a solid foundation for subsequent buybacks, which are expected to further enhance shareholder returns.

- Positive Market Reaction: Fresenius Medical's shares rose by 0.82% to €39.33 on XETRA, reflecting investor optimism regarding the buyback program, which may bolster market expectations for the company's future performance.

- Diverse Use of Repurchased Shares: The repurchased shares will primarily be canceled, with a portion potentially allocated for incentive-based compensation plans, which not only helps improve earnings per share but also enhances employee motivation and loyalty.

Growth Potential: Fresenius Medical Care AG & Co. is positioned for growth through strategic acquisitions and partnerships, with a projected earnings increase of 13.8% over the next five years, despite facing rising costs and a challenging labor environment.

Strong Global Presence: The company has established a robust global footprint, operating 3,624 clinics and caring for over 308,000 patients, while expanding its reach through acquisitions and partnerships in various regions, including recent entries into Israel and India.

Q3 Performance: FMS reported strong third-quarter results, exceeding earnings and revenue estimates, and confirmed its target for significant annual savings through its FME25 transformation program, despite facing inflation and workforce-related cost challenges.

Market Outlook: The Zacks Consensus Estimate for 2025 anticipates a revenue growth of 7.5% to $22.48 billion and a 33.7% increase in earnings per share, indicating a positive outlook for the company amidst ongoing market pressures.

- Executive Transition: Fresenius Medical Care has appointed Charles Hugh-Jones, MD, as Global Chief Medical Officer effective January 1, 2026, succeeding retiring Frank Maddux, ensuring a smooth leadership transition.

- Rich Experience: Dr. Hugh-Jones previously served as CEO of Volastra Therapeutics, advancing oncology assets, and held senior roles at Allergan and Pfizer, accumulating extensive medical and business leadership experience.

- Strategic Importance: The new CMO's appointment will enhance Fresenius Medical Care's leadership in renal care, driving the rollout of the 5008X CAREsystem in the U.S. to set a new standard in kidney care.

- Management Support: Helen Giza, CEO of Fresenius Medical Care, stated that Hugh-Jones's clinical leadership and corporate experience will foster innovation in future patient care, further solidifying the company's market position.

New Appointment: Fresenius Medical Care has appointed Charles Hugh-Jones as Global Chief Medical Officer, effective January 1, 2026, succeeding Franklin Maddux who is retiring.

Background of New CMO: Charles Hugh-Jones previously served as CEO of Volastra Therapeutics and was Chief Medical Officer at Allergan.

Future Plans: Hugh-Jones aims to set a new standard of kidney care in the U.S. with the introduction of the 5008X CAREsystem.

Stock Performance: Following the announcement, Fresenius Medical's stock rose by 0.61%, reaching EUR 39.50 on the XETRA exchange.