First Wilshire Reduces Camtek Stake by $2.67 Million in Q3

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Dec 25 2025

0mins

Should l Buy CAMT?

Source: Fool

- Stake Reduction: First Wilshire Securities Management sold 81,598 shares of Camtek in Q3, resulting in a $2.67 million decrease in stake value, indicating a cautious outlook on the company's future performance.

- Ownership Shift: Following the transaction, First Wilshire's stake in Camtek decreased to 206,424 shares, valued at $21.68 million, which now constitutes 5.77% of its total reportable AUM, reflecting a strategic adjustment in its investment portfolio.

- Market Performance: Camtek shares are currently priced at $109.14, having risen approximately 30% over the past year, significantly outperforming the S&P 500's 15% increase during the same period, showcasing its strong position in the semiconductor equipment sector.

- Financial Health: Camtek reported record third-quarter revenue of $126 million, up 12% year-over-year, with full-year revenue expected to reach around $495 million, indicating sustained growth driven by AI-related advanced packaging demand.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy CAMT?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on CAMT

Wall Street analysts forecast CAMT stock price to fall

12 Analyst Rating

9 Buy

3 Hold

0 Sell

Strong Buy

Current: 157.540

Low

110.00

Averages

129.08

High

145.00

Current: 157.540

Low

110.00

Averages

129.08

High

145.00

About CAMT

Camtek Ltd is an Israel-based manufacturer of metrology and inspection equipment and a provider of software solutions. The Company mainly serves Advanced Packaging, Memory, Complementary Metal Oxide Semiconductor (CMOS) Image Sensors, Micro Electro Mechanical Sensor (MEMS), Radio Frequency (RF), and other segments in the mid-end of the semiconductors industry. The Company has more than seven offices around the world and provides tailor-made solutions in line with customers' requirements. Camtek Ltd's subsidiaries are Camtek Europe SA, Camtek Korea Ltd, Camtek South East Asia Pte Ltd, Camtek USA Inc, Sela - Semiconductor Engineering Laboratories USA Inc, Camtek Japan Ltd and Sela Semiconductor Engineering Laboratories Ltd, among others.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Strong Earnings Report: Camtek reported a Q4 non-GAAP EPS of $0.81, meeting expectations, while revenue reached $128.1 million, reflecting a 9.2% year-over-year increase and surpassing estimates by $1.01 million, indicating robust market performance.

- Growth Outlook: Based on backlog, order pipeline, and customer discussions, management anticipates double-digit growth in 2026, demonstrating confidence in future market demand.

- Quarterly Projections: Management expects Q1 2026 revenues to be around $120 million, with growth anticipated in Q2 and more significant growth in the latter half of 2026, highlighting strong demand in AI applications.

- Major Order Secured: Camtek has received a $25 million order for Hawk systems focused on AI applications, further solidifying its market position amid the rapidly evolving AI investment supercycle.

See More

- 2025 Revenue Growth: Camtek achieved revenues of $496.1 million in 2025, a 16% increase from 2024, indicating strong demand in the semiconductor equipment market, which is expected to further drive future performance.

- Strong Q4 Performance: The fourth quarter of 2025 saw revenues of $128.1 million, a 9% year-over-year increase, with a gross margin of 50%, demonstrating effective management of costs and market demand.

- Robust Cash Flow: Operating cash flow for 2025 was $142.6 million, reflecting the company's solid financial health and providing ample funding for future investments and expansions.

- Optimistic Future Outlook: Management anticipates first-quarter 2026 revenues of around $120 million, with expectations for double-digit growth throughout the year, reflecting strong demand in the AI market and a growing pipeline of customer orders.

See More

- Quarterly Revenue Growth: Camtek's Q4 2025 revenue reached $128.1 million, a 9% year-over-year increase, indicating strong demand in the semiconductor equipment market and suggesting further growth potential.

- Impressive Annual Performance: Total revenue for 2025 was $496.1 million, a 16% increase, although GAAP net income fell 43% to $50.7 million, while non-GAAP net income rose 15% to $159.0 million, highlighting ongoing profitability improvements.

- Gross Margin Improvement: The GAAP gross margin for Q4 was 50.0%, up from 49.6% in Q4 2024, with non-GAAP gross margin increasing from 50.6% to 51.1%, reflecting effective cost control and product mix optimization.

- Optimistic Future Outlook: Management expects double-digit revenue growth in 2026, with Q1 revenues projected at around $120 million, indicating strong demand in the AI market and a growing pipeline of customer orders.

See More

- Significant Order Value: Camtek announced a $25 million order for its Hawk inspection and metrology systems from a tier-1 integrated device manufacturer, indicating strong ongoing demand from the customer based on a series of smaller repeat orders.

- Cumulative Order Total: This order brings the total value of Hawk system orders from this customer to $45 million, reflecting Camtek's robust market position and customer trust within the semiconductor industry.

- Delivery Timeline: The systems are scheduled for delivery in 2026, demonstrating Camtek's capability to meet long-term customer needs while laying the groundwork for future revenue growth.

- Technological Application Outlook: The Hawk platform is utilized in advanced semiconductor packaging applications, including high-bandwidth memory, chiplets, and hybrid bonding, highlighting the strategic importance of Camtek's offerings in the rapidly evolving AI application market and enhancing its competitive edge.

See More

- Earnings Release Schedule: Camtek Ltd. will announce its Q4 and full year 2025 financial results on February 18, 2026, reflecting the company's ongoing development and market performance in the semiconductor industry.

- Video Conference Details: Following the earnings release, CEO Rafi Amit, CFO Moshe Eisenberg, and COO Ramy Langer will host a Zoom video conference at 9:00 am ET to discuss the financial results and answer investor questions, enhancing transparency and communication.

- Registration Process: Investors must register in advance to participate in the Zoom call, and upon registration, they will receive a link to the conference, ensuring timely access to the company's latest updates and improving investor relations management.

- Replay Availability: For those unable to attend live, a replay link will be available within hours after the call, ensuring widespread dissemination and accessibility of information, further strengthening the connection between the company and its investors.

See More

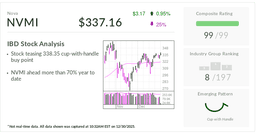

- AI-Driven Demand Surge: Nova, as a supplier of semiconductor manufacturing equipment, is experiencing strong business growth driven by the AI megatrend, highlighting the company's significant position in a rapidly evolving market.

- Increased Market Recognition: The widespread application of AI technologies has led to a notable increase in demand for Nova's products, further solidifying its leadership in the semiconductor industry.

- Rising Investor Interest: Being named IBD Stock Of The Day reflects heightened investor recognition of Nova's future growth potential, which could drive stock price appreciation.

- Strategic Market Positioning: The company's robust performance in AI-related sectors indicates a strategic alignment with market trends, likely attracting more investor attention moving forward.

See More