First National Reports Record Q4 Performance, Dividend Up 9.7%

"We are pleased to report a record fourth quarter of financial performance, as well as a record year. We spent 2025 integrating the Touchstone family and operations into our company, with a major focus on customer retention. The addition of experienced bankers in our Richmond, Roanoke, and Staunton markets helped support our net loan growth in the fourth quarter. We delivered a strong return to our shareholders as we increased our quarterly dividend in the fourth quarter 9.7% and grew our per share tangible book value 14% - all of which helped drive a stock price increase of 9.7% for the year. We are extremely pleased to deliver a double-digit return for our shareholders in 2025," said Scott C. Harvard, President and Chief Executive Officer of First National.

Trade with 70% Backtested Accuracy

Analyst Views on FXNC

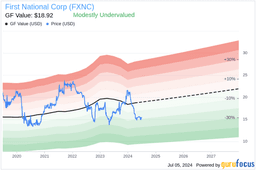

About FXNC

About the author

First National Bank Q4 Financial Highlights

- Earnings Per Share Growth: First National Bank reported a Q4 GAAP EPS of $0.61, a significant increase from $0.00 a year prior, reflecting enhanced profitability and restored market confidence.

- Slight Decline in ROA: The return on average assets stood at 1.06%, a slight decrease from 1.09% in the previous quarter but still higher than 0.18% a year ago, indicating stability in asset management.

- Significant Loan Growth: The bank experienced a loan growth of $16.3 million for the quarter, translating to an annualized growth rate of 4.6%, suggesting increased activity in the lending market that could boost future revenues.

- Improved Asset Quality: Non-performing assets declined to 0.32% of total loans, demonstrating effective risk management and asset quality control measures, which enhance investor confidence.

First National Corporation Reports Record Financial Performance for 2025

- Quarterly Net Income Surge: First National Corporation reported a net income of $5.5 million for Q4 2025, rebounding significantly from a loss of $1 million in the same quarter last year, demonstrating a strong financial recovery post-Touchstone integration that boosts investor confidence.

- Earnings Per Share Growth: The company achieved a basic earnings per share of $1.97 for the full year 2025, up 97% from $1.00 in 2024, reflecting successful strategies in customer retention and loan growth that further enhance shareholder returns.

- Significant Loan Growth: The company experienced a loan growth of $16.3 million in Q4, with an annualized growth rate of 4.6%, supported by a team of experienced bankers in the Richmond, Roanoke, and Staunton markets, strengthening its competitive position.

- Increased Shareholder Returns: The company raised its quarterly dividend by 9.7% in Q4 while growing tangible book value per share by 14%, which not only enhances shareholder investment returns but also lays a foundation for future capital growth.