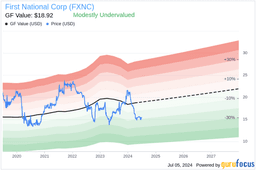

First National Board Increases Quarterly Dividend by 9.7% to $0.17 per Share

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Nov 13 2025

0mins

- Dividend Announcement: First National Corporation's Board of Directors declared a quarterly cash dividend of $0.17 per share.

- Record Date: Shareholders of record will be on November 28, 2025.

- Payment Date: The dividend will be paid on December 12, 2025.

- Increase in Dividend: This represents a 9.7% increase from the previous dividend of $0.155 per share.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy FXNC?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on FXNC

About FXNC

First National Corporation is a bank holding company for First Bank (the Bank), which is a commercial bank. The Bank offers loan, deposit, and wealth management products and services. Its loan products and services include consumer loans, residential mortgages, home equity loans and commercial loans. Deposit products and services include checking accounts, treasury management solutions, savings accounts, money market accounts, certificates of deposit and individual retirement accounts. Wealth management services include estate planning, investment management of assets, trustee under an agreement, trustee under a will, individual retirement accounts and estate settlement. Its customers include small and medium-sized businesses, individuals, estates, local governmental entities, and non-profit organizations. It operates over 33 branches throughout the Shenandoah Valley, central regions of Virginia, and the Richmond and Roanoke market areas.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

First National Bank Q4 Financial Highlights

- Earnings Per Share Growth: First National Bank reported a Q4 GAAP EPS of $0.61, a significant increase from $0.00 a year prior, reflecting enhanced profitability and restored market confidence.

- Slight Decline in ROA: The return on average assets stood at 1.06%, a slight decrease from 1.09% in the previous quarter but still higher than 0.18% a year ago, indicating stability in asset management.

- Significant Loan Growth: The bank experienced a loan growth of $16.3 million for the quarter, translating to an annualized growth rate of 4.6%, suggesting increased activity in the lending market that could boost future revenues.

- Improved Asset Quality: Non-performing assets declined to 0.32% of total loans, demonstrating effective risk management and asset quality control measures, which enhance investor confidence.

Continue Reading

First National Corporation Reports Record Financial Performance for 2025

- Quarterly Net Income Surge: First National Corporation reported a net income of $5.5 million for Q4 2025, rebounding significantly from a loss of $1 million in the same quarter last year, demonstrating a strong financial recovery post-Touchstone integration that boosts investor confidence.

- Earnings Per Share Growth: The company achieved a basic earnings per share of $1.97 for the full year 2025, up 97% from $1.00 in 2024, reflecting successful strategies in customer retention and loan growth that further enhance shareholder returns.

- Significant Loan Growth: The company experienced a loan growth of $16.3 million in Q4, with an annualized growth rate of 4.6%, supported by a team of experienced bankers in the Richmond, Roanoke, and Staunton markets, strengthening its competitive position.

- Increased Shareholder Returns: The company raised its quarterly dividend by 9.7% in Q4 while growing tangible book value per share by 14%, which not only enhances shareholder investment returns but also lays a foundation for future capital growth.

Continue Reading