DoorDash's Competitive Edge Continues to Attract Wall Street Attention

Written by Emily J. Thompson, Senior Investment Analyst

Updated: 1 day ago

0mins

Should l Buy DASH?

Source: stocktwits

- Revenue Growth Expectations: Wall Street anticipates DoorDash will report quarterly revenue of $3.99 billion, reflecting a substantial 39% year-over-year increase, indicating significant future growth potential supported by a healthy consumer base.

- Optimistic Analyst Ratings: According to Koyfin, 34 out of 44 analysts have rated DoorDash as ‘Buy’ or higher, demonstrating strong market confidence in its future performance, with an average price target of $272.07, implying a 68% upside potential.

- Advertising Revenue Driver: Both DoorDash and Instacart are positioning advertising as a key growth driver, as more consumer brands turn to these platforms for targeted marketing, which is expected to further enhance DoorDash's market share and revenue growth.

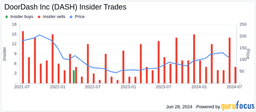

- Retail Sentiment Shift: Data from Stocktwits shows that retail sentiment on DoorDash has shifted from ‘neutral’ to ‘bullish’ over the past three months, indicating a significant increase in investor confidence regarding the company's future performance, despite a nearly 24% decline in stock price over the past year.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy DASH?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on DASH

Wall Street analysts forecast DASH stock price to rise

21 Analyst Rating

18 Buy

3 Hold

0 Sell

Strong Buy

Current: 162.340

Low

224.00

Averages

278.67

High

330.00

Current: 162.340

Low

224.00

Averages

278.67

High

330.00

About DASH

DoorDash, Inc. is engaged in providing services that reduce friction in local commerce and help merchants connect with consumers in their communities. The Company's primary offerings include the DoorDash Marketplace and the Wolt Marketplace (together, the Marketplaces), and its Commerce Platform. The Company's Marketplaces operate in over 30 countries across the globe and provide an integrated suite of services that help merchants establish an online presence, connect with consumers in their communities, and solve mission-critical challenges, such as customer acquisition, demand generation, order fulfillment, merchandising, payment processing, and customer support. It also offers advertising as a value-added service through its Marketplaces to help merchants and consumer packaged goods companies increase consumer engagement. The Company also has offsite advertising capabilities. Its white-label delivery fulfillment services include DoorDash Drive On-Demand and Wolt Drive.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Significant Order Growth: DoorDash's total orders surged 32% year-over-year to 903 million in Q4, surpassing expectations of 885 million, indicating robust market demand and user growth potential, thereby strengthening the company's position in the competitive food delivery market.

- Increased Market Value: The marketplace gross order value (GOV) rose 39% to $29.7 billion, exceeding the expected $29.17 billion, reflecting increased consumer spending and further driving revenue growth and market share expansion for the company.

- Profitability Challenges: Despite total sales rising 36.6% to $3.96 billion, this fell short of expectations by $30 million, and earnings per share increased 45% to $0.048, failing to meet market forecasts, highlighting pressures on cost control and profitability.

- Future Investment Plans: DoorDash anticipates ongoing significant investments in new categories and international markets, with Q1 marketplace GOV expected between $31 billion and $31.8 billion, demonstrating the company's confidence in future growth and its ability to seize market opportunities.

See More

- Revenue Comparison: Corrected DoorDash's Q4 revenue is reported at USD 3,955 million.

- Estimate Correction: This figure is lower than the previous estimate of USD 3,993 million.

See More

- Fed Minutes Analysis: The January FOMC minutes indicate broad support among policymakers for pausing rate cuts despite ongoing inflation risks, which could influence future monetary policy directions and affect market sentiment and investment decisions.

- Walmart Earnings Preview: Walmart is set to report earnings before the bell today, with investors keenly awaiting insights from the new CEO regarding consumer health and demand, which will directly impact retail sector performance and investor confidence.

- Meta Smartwatch Plans Revived: Reports suggest that Meta has revived its smartwatch plans targeting a launch this year, a strategic shift that could enhance its competitiveness in the wearables market and provide new revenue streams for the company.

- Economic Data and Market Reaction: Key economic indicators such as Initial Jobless Claims and the Philly Fed Business Index are scheduled for release today, with investors closely monitoring their impact on the market, especially amid heightened uncertainty regarding Fed policies.

See More

- Market Expectations Rise: DoorDash's first-quarter marketplace gross order value (GOV) forecast ranges from $31 billion to $31.8 billion, exceeding analyst expectations of $29.61 billion, indicating strong performance and growth potential in the market.

- Stock Price Surge: DoorDash shares jumped 14% in premarket trading on Thursday, reflecting investor optimism about the company's future growth, particularly following the acquisition of Deliveroo, which has bolstered confidence in its integration capabilities.

- Integration Challenges: CEO Tony Xu highlighted that consolidating the three platforms of DoorDash, Deliveroo, and Wolt into a single technology platform is a “massive and expensive undertaking,” yet this move is expected to enhance operational efficiency and reduce delays caused by multi-platform operations.

- Retail Sentiment Shift: According to Stocktwits data, retail sentiment on DoorDash has surged from 'bullish' to 'extremely bullish,' indicating a significant increase in investor confidence about the company's future, despite a 14% decline in stock price over the past 12 months.

See More

- Significant Transaction Value: Etsy has entered into a definitive agreement with eBay to sell its fashion marketplace Depop for approximately $1.2 billion in cash, which not only provides Etsy with substantial cash flow but also enhances its financial flexibility to support future strategic investments.

- Stock Price Surge: Etsy's shares jumped 15.5% to $50.86 in pre-market trading, reflecting a positive market reaction to the deal and increasing investor confidence in the company's future growth potential.

- Market Consolidation Trend: This transaction signifies further consolidation in the e-commerce sector, as eBay's acquisition of Depop will expand its influence in the fashion market, while Etsy can focus on its core business to improve operational efficiency.

- Strategic Focus Shift: By selling Depop, Etsy can reallocate resources to concentrate on growth within its primary platform, with expectations to drive long-term profitability through optimizing product lines and enhancing user experience.

See More