Digital Realty Reports Q1 Revenue of $1.63B

Reports Q1 revenue $1.63B, consensus $1.58B. "Digital Realty delivered strong financial results in 2025, with robust top-line growth, record leasing across our 0-1 megawatt plus interconnection offering, and a substantial backlog that provides clear revenue visibility into 2026 and beyond," said Digital Realty President and CEO Andy Power. "The evolution of our private capital strategy is enabling us to efficiently scale development while maintaining a flexible balance sheet positioned for growth. At the same time, we're expanding the PlatformDIGITAL footprint to meet rising global demand. Together, these initiatives strengthen our ability to support our customers' cloud and AI roadmaps while driving long term value for shareholders."

Trade with 70% Backtested Accuracy

Analyst Views on DLR

About DLR

About the author

- Investor Trends: Investors are moving away from AI investments despite a significant market surge today.

- Data Center REITs: The only exception to this trend is the continued interest in data center real estate investment trusts (REITs).

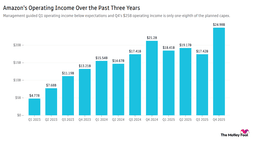

- Amazon's Capital Expenditure Surge: Amazon plans to increase its capital expenditure to $200 billion in 2026, nearly matching its total revenue of $213 billion for Q4, leading to an over 8% drop in stock price during morning trading, indicating market concerns about its financial health.

- Accelerating AWS Growth: CEO Andy Jassy reported a 24% growth rate for AWS, the fastest in 13 quarters, with an annualized revenue of $142 billion; however, management anticipates Q1 operating income will fall short of analyst expectations, reflecting intensified market competition.

- Bitcoin Price Volatility: Bitcoin has dropped 50% from its 2025 peak, falling to around $60,000, which reflects waning confidence in government support for cryptocurrencies, although some analysts suggest this is merely a market correction rather than the end of crypto.

- Severe Market Reactions: Despite a 10% revenue increase in Q3, DOCS and PIDoximity saw their stock plunge over 30% due to declining net income under margin pressure, highlighting investors' acute sensitivity to profitability.

- Price Adjustment: Stifel has reduced the target price for Digital Realty Trust Inc. from $210 to $200.

- Market Impact: This adjustment reflects changes in market conditions and expectations for the company's performance.

- Record Financial Performance: Digital Realty Trust achieved a core FFO of $7.39 per share in 2025, marking a 10% increase over 2024, which underscores the company's robust growth momentum in the data center industry and solidifies its market leadership.

- Leasing Performance Breakthrough: The company signed over $1 billion in new leases in 2025, setting a historical record, while the 0 to 1 megawatt interconnection product category established a new quarterly leasing record in Q4, indicating sustained strong market demand.

- Strategic Expansion Initiatives: Digital Realty expanded into Indonesia and Malaysia in the Asia-Pacific region and successfully attracted over $3.2 billion in LP equity commitments, demonstrating its strong appeal in private markets and potential for future growth.

- Optimistic Future Outlook: The company projects core FFO guidance for 2026 to be between $7.90 and $8.00 per share, reflecting an 8% year-over-year growth, while anticipating total revenue and adjusted EBITDA growth of over 10%, indicating sustained strength in its business and balanced investment spending.

- Core FFO Growth: Digital Realty Trust reported a core FFO of $1.86 per share for Q4 2025 and $7.39 for the full year, marking a 10% increase over 2024, indicating robust performance and sustained profitability in the data center sector.

- Record Leasing Performance: The company signed over $1 billion in new leases for 2025, achieving a historic high, with zero to one megawatt interconnection bookings reaching $96 million in Q4, a 7% increase over the previous record, reflecting strong demand for data center capacity.

- Increased Capital Commitments: By the end of 2025, Digital Realty Trust secured over $3.2 billion in LP equity commitments for its inaugural closed-end fund, marking a successful entry into private markets and further supporting its growth strategy for hyperscale data centers.

- Optimistic Future Outlook: The company anticipates an 8% growth in core FFO per share for 2026, setting a guidance range of $7.90 to $8.00, reflecting confidence in the ongoing demand for cloud and AI services while planning to increase capital expenditures by $3.25 billion to $3.75 billion over the next two years.