Zacks Industry Outlook Spotlights Air Products and Chemicals, Albemarle, and Avient

Industry Challenges: The Zacks Chemicals Diversified industry is facing demand headwinds due to lower consumer spending, particularly in the building & construction and consumer electronics markets, exacerbated by inflation and economic slowdowns in Europe and China.

Strategic Responses: Companies like Air Products, Albemarle, and Avient are implementing cost-cutting measures, improving operational efficiency, and raising prices to maintain margins amid these challenges.

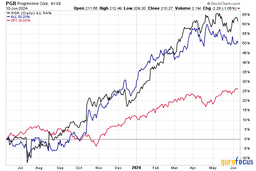

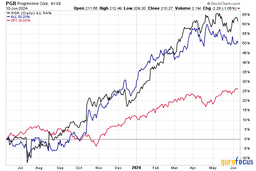

Market Performance: The Chemicals Diversified industry has underperformed compared to the S&P 500 and the broader Basic Materials sector, with a significant decline in stock value over the past year.

Stock Recommendations: Analysts suggest keeping an eye on Air Products, Albemarle, and Avient, highlighting their strategic initiatives and potential for earnings growth despite current market difficulties.

Get Free Real-Time Notifications for Any Stock

Analyst Views on APD

About APD

About the author

Air Products Stock Increases 4.9% Following Surge in Q1 Profits

Stock Performance: Air Products shares have increased by 4.9% following a significant rise in profits for the first quarter.

Profit Growth: The company reported a notable jump in profits, contributing to the positive stock performance.

Air Products to Announce Q1 Earnings on January 30

- Earnings Announcement: Air Products is set to release its Q1 2023 earnings on January 30 before market open, with consensus EPS estimate at $3.04, reflecting a 6.3% year-over-year increase, and revenue estimate at $3.05 billion, up 4.0% year-over-year.

- Historical Performance: Over the past two years, Air Products has beaten EPS estimates 75% of the time, while only surpassing revenue estimates 13% of the time, indicating volatility in its earnings performance.

- Estimate Revisions: In the last three months, EPS estimates have seen two upward revisions and six downward adjustments, while revenue estimates have experienced one upward revision and six downward changes, suggesting market caution regarding the company's future performance.

- Analyst Rating Changes: While Bank of America upgraded Air Products, citing an improved risk-reward profile, Citi raised concerns about project economics, highlighting strategic uncertainties surrounding the company.