USD/JPY Falls Below 154.00 as Japan Observes Holiday Today.

Japanese Markets: Japanese markets are closed for a holiday, leading to thinner yen trading in other centers.

Market News: There is no fresh news impacting the markets today.

NFP Preview: The consensus for January's non-farm payrolls is high, indicating expectations for strong job growth.

Goldman Analysis: Goldman Sachs has flagged substantial downside risks to the upcoming January jobs report.

Trade with 70% Backtested Accuracy

Analyst Views on JPY

No data

About the author

USD Overview: The US Dollar initially rose after a strong NFP report but lost gains as the market anticipates the upcoming US CPI report, which could significantly impact rate expectations and the dollar's strength.

JPY Overview: Following Takaichi's election victory, the JPY experienced a "sell the fact" reaction, with no new developments from the Bank of Japan, which maintains a steady interest rate while hinting at potential future hikes based on economic data.

USDJPY Technical Analysis - Daily: The USDJPY has retraced to a major trendline, where buyers are expected to enter, aiming for a rally towards 159.00, while sellers will look for a break below to target 145.00.

Upcoming Economic Data: Key economic indicators, including US Jobless Claims and the US CPI report, are set to be released, which will likely influence market movements and sentiment.

Hedge Funds Shift to Bullish Yen Positions: Hedge funds are reversing their stance and rebuilding bullish positions on the yen, driven by a growing "buy Japan" narrative, despite strong US jobs data that previously supported dollar strength.

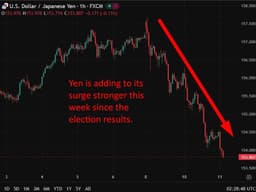

Yen Strengthens Against the Dollar: The yen has appreciated for three consecutive sessions against the dollar, indicating a significant shift in market sentiment and positioning, particularly after Japan's recent election results.

Increased Demand for Yen Protection: Options markets are showing heightened demand for downside protection on the dollar-yen pair, with trading volumes for put contracts significantly surpassing call options, reflecting a growing appetite for yen upside exposure.

Political Stability and Market Reactions: The recent election victory of Japan's Liberal Democratic Party has contributed to perceptions of political stability, further supporting the yen and Japanese equities, while authorities signal readiness to manage excessive currency fluctuations.

Market Sentiment: Traders are cautious amid intervention risks, with the recent snap election in Japan strengthening Prime Minister Takaichi's mandate for fiscal plans, yet the anticipated "Takaichi trade" has not gained momentum this week.

Currency Movements: The USD/JPY pair is experiencing downward pressure, with a third consecutive daily drop and a significant break below the 100-day moving average, indicating a shift in bullish momentum.

Technical Levels: Key support levels to watch include the end-January low near 152.10-15, with potential further retracement towards the 200-day moving average and the 150.00 mark if this level is breached.

Future Outlook: Despite current selling pressure, analysts predict that USD/JPY could eventually rise towards 160.00 before any potential intervention from Tokyo, as profit-taking strategies are likely in play amid concerns over the yen's stability.

Japanese Markets: Japanese markets are closed for a holiday, leading to thinner yen trading in other centers.

Market News: There is no fresh news impacting the markets today.

NFP Preview: The consensus for January's non-farm payrolls is high, indicating expectations for strong job growth.

Goldman Analysis: Goldman Sachs has flagged substantial downside risks to the upcoming January jobs report.

Market Reaction to Takaichi's Election: USD/JPY has declined for two consecutive days following Takaichi's election win, with a significant influx of money into Japanese equities, pushing the Nikkei up 7% in two days.

Economic Stability and Reforms: Takaichi's strong government majority provides stability and the potential for structural economic reforms, although the market is cautious about her promised stimulus measures.

US Dollar Concerns: Recent weak US economic data, including soft job numbers and retail sales, raises concerns about the dollar, with upcoming reports expected to influence market sentiment.

Technical Analysis of USD/JPY: The USD/JPY has breached the 100-day moving average, with potential targets at the January low of 152.27 and the 200-day moving average at 150.39, as traders await key economic reports.

USD Performance: The US Dollar weakened due to a lack of catalysts, with analysts attributing the decline to China's banks reducing exposure to US Treasuries, while the market anticipates key economic reports, particularly the US NFP report, which could influence Fed rate expectations.

JPY Update: The Japanese Yen saw a rally following PM Takaichi's expected election victory, with the Bank of Japan maintaining interest rates and slightly upgrading growth and inflation forecasts, although recent data has not supported a rate hike.

USDJPY Technical Analysis: The USDJPY pair experienced a drop amid the "sell the fact" reaction to Takaichi's victory, with current trading positioned between intervention levels and trendlines, indicating potential bullish and bearish trading opportunities.

Upcoming Economic Data: Key economic indicators are set to be released, including US Retail Sales, Employment Cost Index, Jobless Claims, and CPI reports, which are expected to significantly impact market movements and Fed policy outlook.