U.S. Antimony Corporation Denies Reuters' Inaccurate Reporting

The company said, "Yesterday's Reuters article that was released to the public, is completely inaccurate, misleading, and inconsistent with the facts as they relate to United States Antimony Corporation and the overall antimony and critical minerals business. The article represents a pattern of speculative reporting that mischaracterizes U.S. government policy and creates unnecessary confusion in the world markets. U.S. Antimony maintains binding, long-term relationships and contractual arrangements with U.S. government agencies that remain fully in effect. There has been no change to our agreements, no change to government obligations, and no impact to our current operations or future outlook. Any suggestion that federal support for domestic antimony supply has weakened is simply incorrect. Antimony remains a designated critical mineral for U.S. national security, and U.S. Antimony is the only producer of finished antimony products in the Western Hemisphere. There is no alternative domestic or regional source capable of supplying this material at scale. We remain fully aligned with our government partners and focused on executing our mission: securing a reliable, domestic antimony supply chain for defense, infrastructure, and advanced manufacturing. Our operational momentum, commercial trajectory, and long-term visibility remain strong and unwavering. The Energy Department told Reuters in a statement after the story was published that the article was 'false and relies on unnamed sources that are either misinformed or deliberately misleading.' The statement did not elaborate on what errors the department said it had found."

Discover Tomorrow's Bullish Stocks Today

Analyst Views on UAMY

About UAMY

About the author

Trump Administration's Policy Shift on Rare Earths Shakes Market

- Policy Shift Impact: The Trump administration informed industry leaders that future rare earth projects must demonstrate “financial independence” without federal price supports, marking a significant reversal from last year's aggressive rhetoric, which could undermine the competitiveness of the U.S. rare earth supply chain.

- Market Reaction: The news triggered a steep sell-off in rare earth and critical minerals stocks, with companies like MP Materials and U.S. Antimony experiencing significant declines, reflecting strong market concerns over policy uncertainty that may affect investor confidence.

- Industry Pushback: MP Materials labeled the report as “fake news” on social media, emphasizing that its existing government contract, which includes a price floor of $110/kg, remains intact, demonstrating the company's determination to counter misleading narratives and protect its interests.

- Clarification Controversy: Following the report's publication, Reuters edited the content, initially implying that existing agreements were being rescinded, later clarifying that the pivot applies only to future projects, raising questions among industry observers about the media's influence on market sentiment.

Microsoft Shares Drop as Spending Surges

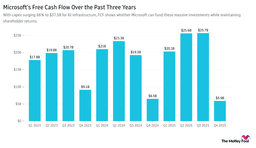

- Microsoft Performance Decline: Microsoft (MSFT) shares fell over 5% in pre-market trading due to disappointing quarterly results, despite a 39% growth in Azure cloud revenue and a 66% increase in capital expenditures, highlighting a tension between significant AI investments and market concerns.

- AI Investment Confidence: CEO Satya Nadella reassured investors that Microsoft's AI business has surpassed some major franchises, indicating strong future growth potential, especially as cloud orders exceed capacity, despite fears of an AI bubble.

- Mineral Stocks Drop: Stocks like MP Materials and United States Antimony Corp fell nearly 10% in early trading after the U.S. government walked back plans to guarantee minimum prices for critical minerals, reflecting a negative impact on market confidence due to policy shifts.

- Consumer Spending Shift: Tractor Supply (TSCO) dropped over 5% after reporting results below expectations, citing a shift in consumer spending as net income remained flat year-over-year, indicating pressure on the retail sector from the current economic environment.