United States Antimony Corporation Expands Antimony Refining Facility in Bolivia

United States Antimony Corporation has been involved since mid-2025 in funding and assisting with the development of a new hydrometallurgical processing facility for refining antimony and other critical minerals on a commercial scale associated with a project located in the country of Bolivia. The company said, "Our financial assistance has allowed this facility to expand 15 times its original size and output. USAC has an exclusive contract to receive the processed "antimony flake" from this Bolivian based facility to the USAC North American processing smelters. First product receipt of approximately 150 tons is anticipated in February/March 2026 at the Company's recently expanded Thompson Falls smelter. Because of the very high quality of this material, actual thruputs at USAC's newly expanded smelters should increase markedly with these volumes and can meet military spec requirements for metal or trioxide products. Additionally, USAC anticipates announcing, in the near future, the duplication of this new facility with additional patented processes in one or more new hydromet facilities to be located in the Western USA and/or Alaska and controlled by our Company."

Discover Tomorrow's Bullish Stocks Today

Analyst Views on UAMY

About UAMY

About the author

Trump Administration's Policy Shift on Rare Earths Shakes Market

- Policy Shift Impact: The Trump administration informed industry leaders that future rare earth projects must demonstrate “financial independence” without federal price supports, marking a significant reversal from last year's aggressive rhetoric, which could undermine the competitiveness of the U.S. rare earth supply chain.

- Market Reaction: The news triggered a steep sell-off in rare earth and critical minerals stocks, with companies like MP Materials and U.S. Antimony experiencing significant declines, reflecting strong market concerns over policy uncertainty that may affect investor confidence.

- Industry Pushback: MP Materials labeled the report as “fake news” on social media, emphasizing that its existing government contract, which includes a price floor of $110/kg, remains intact, demonstrating the company's determination to counter misleading narratives and protect its interests.

- Clarification Controversy: Following the report's publication, Reuters edited the content, initially implying that existing agreements were being rescinded, later clarifying that the pivot applies only to future projects, raising questions among industry observers about the media's influence on market sentiment.

Microsoft Shares Drop as Spending Surges

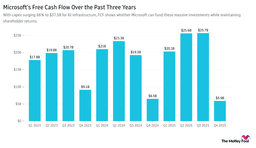

- Microsoft Performance Decline: Microsoft (MSFT) shares fell over 5% in pre-market trading due to disappointing quarterly results, despite a 39% growth in Azure cloud revenue and a 66% increase in capital expenditures, highlighting a tension between significant AI investments and market concerns.

- AI Investment Confidence: CEO Satya Nadella reassured investors that Microsoft's AI business has surpassed some major franchises, indicating strong future growth potential, especially as cloud orders exceed capacity, despite fears of an AI bubble.

- Mineral Stocks Drop: Stocks like MP Materials and United States Antimony Corp fell nearly 10% in early trading after the U.S. government walked back plans to guarantee minimum prices for critical minerals, reflecting a negative impact on market confidence due to policy shifts.

- Consumer Spending Shift: Tractor Supply (TSCO) dropped over 5% after reporting results below expectations, citing a shift in consumer spending as net income remained flat year-over-year, indicating pressure on the retail sector from the current economic environment.