United States Antimony Acquires Montana Facility for $4.75 Million

Written by Emily J. Thompson, Senior Investment Analyst

Updated: 6d ago

0mins

Source: stocktwits

- Facility Acquisition: United States Antimony Corporation acquired a mineral flotation facility in Radersburg, Montana for $4.75 million in cash, marking a strategic expansion in critical minerals that is expected to enhance production capacity.

- Future Investment Plans: The company has budgeted approximately $2 million for specific equipment improvements at the facility, which will boost operational efficiency and support future mineral processing demands, further solidifying its market position.

- Strong Stock Performance: Driven by optimism among retail investors, UAMY shares rallied over 7% on Friday and became a trending stock on Stocktwits, indicating strong market confidence in its future performance.

- Yearly Price Expectations: With a 514% increase in share price over the past 12 months, retail investors' expectations for the stock to double this year have intensified, reflecting high recognition of the company's potential in the market.

Discover Tomorrow's Bullish Stocks Today

Receive free daily stock recommendations and professional analysis to optimize your portfolio's potential.

Sign up now to unlock expert insights and stay one step ahead of the market trends.

Analyst Views on UAMY

Wall Street analysts forecast UAMY stock price to rise over the next 12 months. According to Wall Street analysts, the average 1-year price target for UAMY is 10.00 USD with a low forecast of 9.75 USD and a high forecast of 10.25 USD. However, analyst price targets are subjective and often lag stock prices, so investors should focus on the objective reasons behind analyst rating changes, which better reflect the company's fundamentals.

3 Analyst Rating

3 Buy

0 Hold

0 Sell

Strong Buy

Current: 9.700

Low

9.75

Averages

10.00

High

10.25

Current: 9.700

Low

9.75

Averages

10.00

High

10.25

About UAMY

United States Antimony Corporation is engaged in the production and sale of antimony, precious metals, primarily gold and silver, and zeolite products. The Company has two reportable segments: antimony and zeolite. Its antimony segment consists of its facility located in the Burns Mining District of Sanders County in Montana that processes ore primarily into antimony oxide, antimony metal, antimony trisulfide, and precious metals, and its two facilities in its US Antimony de Mexico, S.A. de C.V. (USAMSA) subsidiary located in Mexico that process ore primarily into antimony metal and a lower grade of antimony oxide. Its zeolite segment includes its vertically integrated Bear River Zeolite (BRZ) facility located in Preston, Idaho that mines, processes, and sells zeolite. Its zeolite has been used in soil amendment and fertilizer, water filtration, and sewage treatment. The Company also operates Fostung Tungsten Property located near Sudbury, Ontario, Canada, near the town of Espanola.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

Trump Administration's Policy Shift on Rare Earths Shakes Market

- Policy Shift Impact: The Trump administration informed industry leaders that future rare earth projects must demonstrate “financial independence” without federal price supports, marking a significant reversal from last year's aggressive rhetoric, which could undermine the competitiveness of the U.S. rare earth supply chain.

- Market Reaction: The news triggered a steep sell-off in rare earth and critical minerals stocks, with companies like MP Materials and U.S. Antimony experiencing significant declines, reflecting strong market concerns over policy uncertainty that may affect investor confidence.

- Industry Pushback: MP Materials labeled the report as “fake news” on social media, emphasizing that its existing government contract, which includes a price floor of $110/kg, remains intact, demonstrating the company's determination to counter misleading narratives and protect its interests.

- Clarification Controversy: Following the report's publication, Reuters edited the content, initially implying that existing agreements were being rescinded, later clarifying that the pivot applies only to future projects, raising questions among industry observers about the media's influence on market sentiment.

Continue Reading

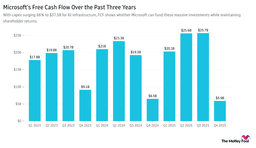

Microsoft Shares Drop as Spending Surges

- Microsoft Performance Decline: Microsoft (MSFT) shares fell over 5% in pre-market trading due to disappointing quarterly results, despite a 39% growth in Azure cloud revenue and a 66% increase in capital expenditures, highlighting a tension between significant AI investments and market concerns.

- AI Investment Confidence: CEO Satya Nadella reassured investors that Microsoft's AI business has surpassed some major franchises, indicating strong future growth potential, especially as cloud orders exceed capacity, despite fears of an AI bubble.

- Mineral Stocks Drop: Stocks like MP Materials and United States Antimony Corp fell nearly 10% in early trading after the U.S. government walked back plans to guarantee minimum prices for critical minerals, reflecting a negative impact on market confidence due to policy shifts.

- Consumer Spending Shift: Tractor Supply (TSCO) dropped over 5% after reporting results below expectations, citing a shift in consumer spending as net income remained flat year-over-year, indicating pressure on the retail sector from the current economic environment.

Continue Reading