Trump Family's Strategy in the Cryptocurrency Market: From Coins to Miners

Trump Family's Cryptocurrency Ventures: The trading debut of the $WLFI token highlights the Trump family's increasing involvement in cryptocurrency, with various ventures including Trump Media & Technology Group's plans to hold bitcoin and partnerships with Crypto.com for new projects.

Financial Gains and Controversies: The Trump family has reportedly earned around $500 million from World Liberty, which issues a dollar-backed stablecoin and has faced criticism over potential conflicts of interest, as President Trump is exempt from conflict of interest laws.

Memecoins and NFTs: The Trump family launched memecoins $TRUMP and $MELANIA, which saw significant initial valuations but have since dropped. Additionally, Trump has entered the NFT market, generating substantial income from digital trading cards.

Future Plans in Crypto: Upcoming initiatives include the launch of American Bitcoin, a new mining venture, and plans for multiple cryptocurrency exchange-traded funds (ETFs) that will track various digital assets, further solidifying the family's presence in the crypto space.

Trade with 70% Backtested Accuracy

Analyst Views on MSTR

About MSTR

About the author

- Earnings Revive Dilution Concerns: Strategy's Q4 results revealed a significant loss primarily due to unrealized Bitcoin markdowns, raising investor concerns about the funding of future Bitcoin purchases, which led to a 2.43% pre-market drop in MSTR shares to $131.63.

- Bitcoin Stress Test Scenario: CEO Phong Le outlined a worst-case scenario where Bitcoin would need to plummet to $8,000, equating the company's Bitcoin reserves with net debt, potentially necessitating restructuring or additional equity issuance, which poses a threat to investor confidence.

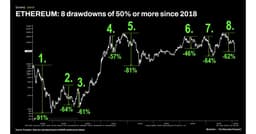

- Long-Term Outlook and Historical Context: Le noted past Bitcoin drawdowns of 75%, yet remains optimistic about Bitcoin's future, predicting it could reach $1 million within seven years, indicating the company's resilience to market fluctuations.

- Market Sentiment Shift: Despite Bitcoin's 0.9% decline to $69,843 over 24 hours, retail sentiment on Stockwits remained neutral, with discussion levels rising from 'extremely low' to 'extremely high', reflecting increasing market interest in Bitcoin.

- Continued Bitcoin Purchases: Strategy Inc. acquired $90 million worth of Bitcoin in the week ending February 8, an increase from $75 million the previous week, indicating ongoing confidence in Bitcoin investment.

- Holding Position Update: As of February 8, Strategy holds 714,644 BTC at an average purchase price of approximately $76,000, totaling an investment of $54.35 billion, reflecting a significant commitment to the cryptocurrency market.

- Stock Price Volatility: During the Bitcoin purchasing period, Strategy's shares fell 4.22% pre-market on Monday to $129.23, suggesting market caution regarding its Bitcoin investment strategy.

- Funding Source Analysis: The Bitcoin purchases were funded through the sale of 616,715 Class A shares, indicating an active capital management strategy to support its cryptocurrency investments.

- Massive Earnings: Since November 2024, World Liberty Financial has generated at least $1.4 billion for the Trump and Witkoff families, surpassing the total earnings of Trump's real estate empire over eight years, highlighting its significant impact in the financial sector.

- Cash Flow and Paper Gains: According to the Wall Street Journal, the Trump family earned at least $1.2 billion in cash and $2.25 billion in paper gains from crypto holdings over 16 months, while the Witkoffs earned at least $200 million, indicating the company's successful operations in the crypto market.

- Ownership Structure and Fund Flow: 75% of WLFI token sales flow directly to a Trump entity, with 12.5% to the Witkoff family and 12.5% to co-founders, as Trump holds a 70% stake in that entity, demonstrating his dominant position within the company.

- Abu Dhabi Deal Accelerates Earnings: The Sheikh of Abu Dhabi purchased 49% of World Liberty for $500 million, providing the Trump family with $187 million in immediate liquidity, further strengthening their financial position and boosting market confidence.

- Revenue Beat: Strategy reported fourth-quarter revenue of $122.99 million after Thursday's close, surpassing analyst expectations of $118.48 million, indicating strong market performance that may attract more investor interest.

- Earnings Growth: The company posted adjusted earnings of $16.37 per share, exceeding analyst estimates of $10.96 per share, demonstrating significant improvement in profitability that could lay the groundwork for future growth.

- Stock Price Decline: Despite the revenue and earnings beats, Strategy's stock dipped 4.8% to $128.36 in pre-market trading, reflecting market concerns about the overall economic environment, which may impact investor confidence.

- Market Trends: U.S. stock futures were lower, with Nasdaq 100 futures falling around 100 points, indicating cautious market sentiment that could pressure tech stocks and influence overall investment strategies.

- Significant ETH Holdings: Bitmine currently holds 2,873,459 ETH, valued at $6.2 billion at $2,125 per ETH, demonstrating the company's robust investment capability in the cryptocurrency market and solidifying its position as the largest ETH treasury globally.

- Growth Investment Potential: In just six months, Bitmine has acquired 3.58% of the ETH supply, nearing its 5% target, and is expected to enhance its market share and revenue potential with the launch of the MAVAN staking solution in Q1 2026.

- Total Cash and Asset Value: Bitmine's total cash and

- ETH Staking Scale: Bitmine currently has 2,873,459 ETH staked, valued at $6.2 billion at $2,125 per ETH, showcasing the company's strong investment capability and market confidence in the crypto asset space.

- Investment and Holdings: Recently, Bitmine closed a $200 million investment in Beast Industries, while its total cash and 'moonshot' holdings reached $10 billion, indicating a proactive strategy in the cryptocurrency market and potential for future growth.

- Market Trading Activity: Bitmine's stock trades at an average daily volume of $1.3 billion in the US, ranking 107th, reflecting its popularity among investors and liquidity, which further solidifies its market position.

- Staking Revenue Growth: The company has achieved annualized staking revenues of $202 million, up 7% from $34 million on January 1, indicating successful implementation of Bitmine's ETH staking strategy and sustainability of future earnings.