Ryman Hospitality Properties Breaks Below 200-Day Moving Average - Notable for RHP

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Oct 21 2024

0mins

Source: NASDAQ.COM

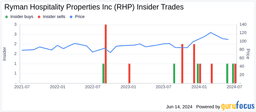

Stock Performance Overview: RHP's stock has a 52-week low of $81.90 and a high of $122.91, with the last trade recorded at $107.80.

Market Analysis Note: The article mentions other dividend stocks that have recently fallen below their 200-day moving average, indicating potential market trends.

Discover Tomorrow's Bullish Stocks Today

Receive free daily stock recommendations and professional analysis to optimize your portfolio's potential.

Sign up now to unlock expert insights and stay one step ahead of the market trends.

Analyst Views on RHP

Wall Street analysts forecast RHP stock price to rise over the next 12 months. According to Wall Street analysts, the average 1-year price target for RHP is 108.71 USD with a low forecast of 92.00 USD and a high forecast of 121.00 USD. However, analyst price targets are subjective and often lag stock prices, so investors should focus on the objective reasons behind analyst rating changes, which better reflect the company's fundamentals.

7 Analyst Rating

6 Buy

1 Hold

0 Sell

Strong Buy

Current: 93.480

Low

92.00

Averages

108.71

High

121.00

Current: 93.480

Low

92.00

Averages

108.71

High

121.00

About RHP

Ryman Hospitality Properties, Inc. is a lodging and hospitality real estate investment trust that specializes in upscale convention center resorts and entertainment experiences. Its holdings include Gaylord Opryland Resort & Convention Center; Gaylord Palms Resort & Convention Center; Gaylord Texan Resort & Convention Center; Gaylord National Resort & Convention Center, and Gaylord Rockies Resort & Convention Center, which are non-gaming convention center hotels in the United States based on total indoor meeting space. It owns the JW Marriott Phoenix Desert Ridge Resort & Spa and JW Marriott San Antonio Hill Country Resort & Spa and two ancillary hotels adjacent to its Gaylord Hotels properties. Its hotel portfolio is managed by Marriott International and includes a combined total of 12,364 rooms and over three million square feet of total indoor and outdoor meeting space in top convention and leisure destinations across the country. It owns an interest in Opry Entertainment Group.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

RHP to Release Q4 2025 Earnings on February 23, 2026

- Earnings Release Schedule: Ryman Hospitality Properties will announce its Q4 2025 earnings after market close on February 23, 2026, which is expected to provide key financial data for investors to assess future growth potential.

- Conference Call Details: Management will hold a conference call at 10 a.m. ET on February 24, 2026, allowing investors to dial in at 800-225-9448 to discuss quarterly results, enhancing transparency and communication with shareholders.

- Replay Service: The conference call will be available for replay until March 3, 2026, by dialing 800-688-9445, ensuring that investors who cannot participate live can still access important information, thereby improving information accessibility.

- Webcast Availability: The call will also be webcast on the company's Investor Relations website, further broadening the channels through which investors can obtain information, reflecting the company's commitment to investor relations.

Continue Reading

RHP to Release Q4 2025 Earnings on February 23, 2026

- Earnings Release Schedule: Ryman Hospitality Properties will announce its Q4 2025 earnings results after market close on February 23, 2026, which is expected to provide key financial data for investors to assess the company's market performance.

- Conference Call Details: Management will hold a conference call at 10 a.m. ET on February 24, 2026, to discuss quarterly results, allowing investors to dial in at 800-225-9448, thereby enhancing transparency and investor confidence.

- Replay Availability: The conference call will be available for replay until March 3, 2026, by dialing 800-688-9445, ensuring that investors who cannot participate live can still access important information.

- Webcast Accessibility: The call will also be webcast on the company's Investor Relations website, further expanding the reach of information dissemination and improving interaction between the company and its investors.

Continue Reading