Hub Group and Essendant Collaborate for 48-Hour Delivery Initiative

Partnership Announcement: Hub Group, Inc. has entered a long-term logistics partnership with Essendant, aiming to enhance supply chain efficiency through a Managed Delivery model that supports two-day warehouse deliveries across major U.S. markets.

Operational Improvements: The collaboration will integrate Hub Group’s logistics infrastructure with Essendant’s distribution network, focusing on streamlining multi-stop shipments, reducing costs, and achieving a 95% on-time delivery performance.

Launch and Scalability: The Managed Delivery model is set to launch on November 1, 2025, under a three-year agreement, allowing for scalable expansion as Essendant's product range and delivery volumes evolve.

Market Impact: Following the announcement, Hub Group's stock saw a 2.08% increase, reflecting positive investor sentiment regarding the strategic partnership and its potential to improve customer service through data-driven logistics.

Trade with 70% Backtested Accuracy

Analyst Views on HUBG

About HUBG

About the author

Cass Transportation Index: Freight Market Softness with Rising Rates

- Volume Decline: The Cass Freight Index reported a 7.2% month-over-month drop in shipments for December, with a year-over-year decline of 7.5%, indicating softness in the freight market despite stabilizing prices, highlighting industry challenges.

- Elevated Expenditures: Although expenditures fell by 1.9% month-over-month in December and only 0.6% year-over-year, this reflects persistent high freight costs that have not decreased as much as shipment volumes, following significant increases in 2021 and 2022.

- Truckload Index Recovery: The Cass Truckload Linehaul Index rose by 1.0% month-over-month in December and posted a 1.8% increase for 2025, recovering from declines of 10% in 2023 and 3.4% in 2024, indicating gradual market recovery.

- Future Demand Outlook: Cass Information Systems suggests that after significant destocking in Q4, a favorable Supreme Court ruling on IEEPA tariffs could act as a positive catalyst for freight demand moving forward.

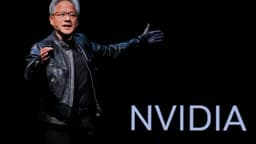

Major Analyst Recommendations for Friday: Nvidia, Apple, CoreWeave, Broadcom, Alphabet, Netflix, and Others

Wall Street Upgrades and Initiations: Several firms have upgraded or initiated coverage on various stocks, including Nvidia, Vital Farms, and CoreWeave, highlighting strong growth potential in sectors like AI and agriculture.

Positive Outlook for Lithium and Health Insurance: UBS upgraded Albemarle due to expected lithium market growth, while Jefferies expressed bullishness on Humana, citing its competitive advantages in the health insurance sector.

Tech Stocks Performance: Mizuho and CLSA reiterated positive ratings for Broadcom and Apple, respectively, with expectations of strong earnings and revenue growth driven by AI and consumer demand.

Market Reactions and Downgrades: Baird downgraded Synchrony, citing overvaluation, while other firms like Morgan Stanley and Wells Fargo initiated coverage on logistics and biotech companies, indicating a mixed sentiment in the market.