Celestica Reports Record Q4 Earnings, Raises 2026 Guidance

Written by Emily J. Thompson, Senior Investment Analyst

Updated: 1d ago

0mins

Source: Benzinga

- Record Performance: Celestica reported Q4 2025 revenue of $3.65 billion, a 44% increase year-over-year, exceeding the guidance range of $3.325 billion to $3.575 billion, highlighting strong performance in the data center infrastructure sector.

- Earnings Growth: The adjusted EPS reached $1.89, surpassing the guidance of $1.65 to $1.81, while GAAP EPS was $2.31, up from $1.29 in the previous year, indicating enhanced profitability.

- 2026 Guidance Upgrade: The company raised its 2026 revenue outlook to $17 billion from $16 billion, with adjusted EPS guidance increasing from $8.20 to $8.75, reflecting robust demand for AI-related data center technologies.

- Capital Investment Plans: CEO Rob Mionis announced a strategic increase in planned capital investments to $1 billion for 2026, expecting to fully fund this expansion organically through operating cash flow, demonstrating confidence in future growth.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy CLS?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on CLS

Wall Street analysts forecast CLS stock price to rise over the next 12 months. According to Wall Street analysts, the average 1-year price target for CLS is 376.73 USD with a low forecast of 305.00 USD and a high forecast of 440.00 USD. However, analyst price targets are subjective and often lag stock prices, so investors should focus on the objective reasons behind analyst rating changes, which better reflect the company's fundamentals.

11 Analyst Rating

9 Buy

2 Hold

0 Sell

Strong Buy

Current: 345.230

Low

305.00

Averages

376.73

High

440.00

Current: 345.230

Low

305.00

Averages

376.73

High

440.00

About CLS

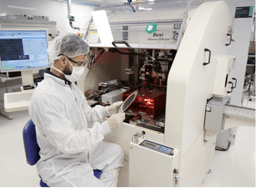

Celestica Inc. is engaged in designing, manufacturing and providing hardware platform and supply chain solutions. It delivers supply chain solutions globally to customers in two operating segments: Advanced Technology Solutions (ATS) and Connectivity & Cloud Solutions (CCS). The ATS segment consists of its ATS end market and comprises its Aerospace & Defense (A&D), Industrial, HealthTech, and Capital Equipment businesses. Its Capital Equipment business comprises its semiconductor, display, and robotics equipment businesses. The CCS segment consists of its communications and enterprise end markets. The enterprise end market consists of Celestica’s servers and storage businesses. It offers a range of product manufacturing and related supply chain services to customers in both of its segments, including design and development, new product introduction, engineering services, component sourcing, electronics manufacturing and assembly, testing, systems integration, among others.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

Celestica Inc. Stock Plummets Despite Strong Earnings Outlook

- Stock Price Drop: Celestica Inc. experienced a significant 13.10% decline in stock price on Thursday, closing at $300 per share, ending a four-day winning streak as strong earnings expectations were already priced in.

- Net Income Surge: The updated report indicates that Celestica's net income for 2025 is projected to soar by 94% to $832.5 million from $428 million in 2024, with Q4 alone contributing $267.5 million, a 76% increase year-over-year.

- Revenue Growth: The company reported a 28% increase in annual revenue to $12.39 billion, while Q4 revenue rose by 4.4% to $3.65 billion, reflecting robust demand for AI-related technologies.

- Optimistic Future Outlook: Celestica raised its revenue forecast for 2026 to $17 billion and plans to increase capital investments to $1 billion, demonstrating confidence in long-term AI infrastructure investments and strategic growth plans.

Continue Reading

Celestica Reports Strong Q4 2025 Earnings with Significant Growth

- Significant Revenue Growth: Celestica achieved $3.65 billion in revenue for Q4 2025, a 44% increase year-over-year, exceeding expectations and demonstrating strong demand in the CCS segment, which solidifies the company's market position.

- Increased Adjusted EPS: The adjusted earnings per share for Q4 reached $1.89, reflecting a 70% increase from the previous year, showcasing the company's operational efficiency and market demand success, likely attracting more investor interest.

- Substantial Capital Expenditure Increase: The company plans to raise capital expenditures to approximately $1 billion in 2026, representing 6% of annual revenue, to support growth in AI and data centers, indicating confidence in future market opportunities.

- Optimistic Outlook: Celestica raised its 2026 revenue outlook to $17 billion and adjusted EPS to $8.75, representing year-over-year growth of 37% and 45%, respectively, reflecting strong confidence in sustained growth.

Continue Reading