CAMTEK REPORTS ALL-TIME HIGH PERFORMANCE FOR Q3 2025

Q3 Financial Performance: Camtek Ltd. reported record revenues of $126 million for Q3 2025, a 12% year-over-year increase, despite a GAAP net loss of $53.2 million due to a one-time capital loss related to convertible notes.

Fourth Quarter Guidance: The company anticipates Q4 2025 revenues to reach approximately $127 million, projecting total annual revenues of $495 million for 2025, marking a 15% growth over 2024.

CEO's Outlook: CEO Rafi Amit expressed optimism about continued growth driven by increasing demand for high-performance computing in AI applications, expecting strong performance in the second half of 2026.

Financial Position: As of September 30, 2025, Camtek's cash and equivalents totaled $794 million, with over $34 million generated from operating activities during the quarter.

Get Free Real-Time Notifications for Any Stock

Analyst Views on CAMT

About CAMT

About the author

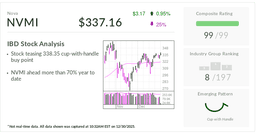

Nova Named IBD Stock Of The Day Amid Strong AI-Driven Demand

- AI-Driven Demand Surge: Nova, as a supplier of semiconductor manufacturing equipment, is experiencing strong business growth driven by the AI megatrend, highlighting the company's significant position in a rapidly evolving market.

- Increased Market Recognition: The widespread application of AI technologies has led to a notable increase in demand for Nova's products, further solidifying its leadership in the semiconductor industry.

- Rising Investor Interest: Being named IBD Stock Of The Day reflects heightened investor recognition of Nova's future growth potential, which could drive stock price appreciation.

- Strategic Market Positioning: The company's robust performance in AI-related sectors indicates a strategic alignment with market trends, likely attracting more investor attention moving forward.

First Wilshire Reduces Camtek Stake by $2.67 Million in Q3

- Stake Reduction: First Wilshire Securities Management sold 81,598 shares of Camtek in Q3, resulting in a $2.67 million decrease in stake value, indicating a cautious outlook on the company's future performance.

- Ownership Shift: Following the transaction, First Wilshire's stake in Camtek decreased to 206,424 shares, valued at $21.68 million, which now constitutes 5.77% of its total reportable AUM, reflecting a strategic adjustment in its investment portfolio.

- Market Performance: Camtek shares are currently priced at $109.14, having risen approximately 30% over the past year, significantly outperforming the S&P 500's 15% increase during the same period, showcasing its strong position in the semiconductor equipment sector.

- Financial Health: Camtek reported record third-quarter revenue of $126 million, up 12% year-over-year, with full-year revenue expected to reach around $495 million, indicating sustained growth driven by AI-related advanced packaging demand.