Axcelis Merges with Veeco, AI Chip Demand to Drive Growth

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Jan 09 2026

0mins

Source: NASDAQ.COM

- Market Share Expansion: Axcelis Technologies is merging with Veeco Instruments, which is expected to expand its addressable market in the semiconductor equipment sector, particularly in AI chip manufacturing, thereby enhancing its competitive position.

- AI Chip Demand Recovery: Although Axcelis has seen year-over-year declines in revenue and net income in recent quarters, management emphasized that high demand for AI chips will serve as a tailwind for the company, potentially driving a return to growth.

- Bitfarms Expansion Plans: Bitfarms is building AI data centers in North America with a 2.1 gigawatt project pipeline, which, while not impacting financial results in the short term, lays the groundwork for securing lucrative multiyear contracts in the future.

- Western Digital Growth Potential: Western Digital achieved a 27% year-over-year revenue growth in its fiscal Q1 2026, primarily driven by demand from data centers, highlighting its critical role in the buildout of AI infrastructure.

Discover Tomorrow's Bullish Stocks Today

Receive free daily stock recommendations and professional analysis to optimize your portfolio's potential.

Sign up now to unlock expert insights and stay one step ahead of the market trends.

Analyst Views on ACLS

Wall Street analysts forecast ACLS stock price to rise over the next 12 months. According to Wall Street analysts, the average 1-year price target for ACLS is 98.50 USD with a low forecast of 84.00 USD and a high forecast of 110.00 USD. However, analyst price targets are subjective and often lag stock prices, so investors should focus on the objective reasons behind analyst rating changes, which better reflect the company's fundamentals.

6 Analyst Rating

3 Buy

3 Hold

0 Sell

Moderate Buy

Current: 91.230

Low

84.00

Averages

98.50

High

110.00

Current: 91.230

Low

84.00

Averages

98.50

High

110.00

About ACLS

Axcelis Technologies, Inc. provides high-productivity solutions for the semiconductor industry. The Company is focused on developing enabling process applications through the design, manufacture and complete life cycle support of ion implantation systems, one of the critical and enabling steps in the IC manufacturing process. Its ion implantation products include high current ion implant, high energy ion implant and medium current ion implant. The Company's Purion H, Purion Dragon, Purion H200, and GSD/E2 Ovation spot beam, high current systems cover all traditional high current requirements as well as those associated with emerging and future devices. Its Purion XE, EXE, and other Purion high energy systems combine its production-proven RF Linac high energy, spot beam technology with the Purion platform wafer handling system. Its medium current ion implant products include its Purion M Si and SiC medium current systems. It also offers its customers aftermarket service and support.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

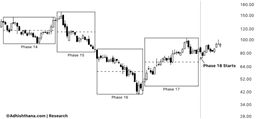

Axcelis Technologies (ACLS) Faces Phase 18 Consolidation with 74% Price Drop

- Phase Analysis: Axcelis Technologies is currently in the final Phase 18 of its cycle, expected to be characterized by consolidation and sluggish price action rather than a trending move, reflecting market caution regarding its future performance.

- Triad Structure Assessment: Under the Adhishthana framework, Axcelis' Phases 14 to 16 failed to exhibit any bullish characteristics, resulting in a price drop from around $160 to the $40s, losing over 74%, which rules out the possibility of a Nirvana move in the current phase.

- Investor Outlook: With a weak triad structure, Axcelis' near-term outlook appears muted, as Phase 18 is likely to be dominated by consolidation and slow movement, making it less suitable for aggressive directional positioning.

- Options Trading Strategy: More experienced options traders might consider range-bound strategies to capitalize on time decay, especially as open interest in out-of-the-money calls continues to build, suggesting limited upside momentum expectations.

Continue Reading

Axcelis Technologies Shifts Focus to AI Market, Achieves 16% Stock Gain

- Market Transformation: Axcelis Technologies achieved a 16% stock gain over the past year, successfully attracting investor interest by shifting its focus to artificial intelligence (AI) sales despite a slowdown in the electric vehicle market.

- Revenue Challenges: Although Axcelis reported a 17% year-over-year revenue decline in Q3, the company highlighted AI as a significant growth opportunity for the future, demonstrating foresight in its technological transition.

- M&A Strategy: The merger plan with Veeco Instruments aims to establish a leading semiconductor equipment company, expected to enhance its market competitiveness and accelerate technological innovation.

- Valuation Outlook: Axcelis's 20 P/E ratio reflects market caution regarding its future growth, but if it can capture market share in AI, it may achieve growth rates similar to those seen from 2021 to 2023.

Continue Reading