Analysts Offer Insights on Financial Companies: Visa (V) and AIA Group (OtherAAIGF)

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Apr 22 2024

0mins

Source: Business Insider

Visa (V) Analyst Rating:

- Mizuho Securities analyst Dan Dolev maintained a Hold rating on Visa with a price target of $265.00.

- Analyst consensus for Visa is Strong Buy with a price target consensus of $309.96.

AIA Group (AAIGF) Analyst Rating:

- CGS-CIMB analyst Michael Chang reiterated a Buy rating on AIA Group with a price target of HK$95.00.

- The analyst consensus on AIA Group is Strong Buy with an average price target of $12.29.

Insider Trading Insights:

- TipRanks has tracked company insiders and identified stocks likely to move following insider activities.

Additional News:

- Visa's price target raised to $320 from $314 at Baird.

- Cowen recommends not overthinking about two 'Strong Buy' credit card stocks.

- DoorDash upgraded, Airbnb downgraded by Wall Street's top analyst.

- Visa initiated with a Buy rating at TD Cowen.

- Capital One Financial's rise despite regulatory concerns.

Discover Tomorrow's Bullish Stocks Today

Receive free daily stock recommendations and professional analysis to optimize your portfolio's potential.

Sign up now to unlock expert insights and stay one step ahead of the market trends.

Analyst Views on V

Wall Street analysts forecast V stock price to rise over the next 12 months. According to Wall Street analysts, the average 1-year price target for V is 406.59 USD with a low forecast of 330.00 USD and a high forecast of 450.00 USD. However, analyst price targets are subjective and often lag stock prices, so investors should focus on the objective reasons behind analyst rating changes, which better reflect the company's fundamentals.

25 Analyst Rating

23 Buy

2 Hold

0 Sell

Strong Buy

Current: 326.980

Low

330.00

Averages

406.59

High

450.00

Current: 326.980

Low

330.00

Averages

406.59

High

450.00

About V

Visa Inc. is a global payments technology company. It facilitates global commerce and money movement across more than 200 countries and territories among a global set of consumers, merchants, financial institutions and government entities through technologies. It operates through the Payment Services segment. It provides transaction processing services (primarily authorization, clearing and settlement) to its financial institution and merchant clients through VisaNet, its proprietary advanced transaction processing network. It offers a range of Visa-branded payment products that its clients, including nearly 14,500 financial institutions, use to develop and offer payment solutions or services, including credit, debit, prepaid and cash access programs for individual, business and government account holders. It also provides value-added services to its clients, including issuing solutions, acceptance solutions, risk and identity solutions, open banking solutions and advisory services.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

Visa Promotes AI Trip Planning Ahead of Winter Olympics

- AI Trip Planning Trend: Visa's Winter Sports Study reveals that 55% of U.S. respondents are considering AI for winter vacation planning, with 40% already using AI tools, indicating a rapid growth in AI applications in travel, which could enhance Visa's market share.

- Domestic Travel Preference: The study shows that 66% of respondents prefer the U.S. as their winter vacation destination, reflecting strong domestic travel demand as the Winter Olympics approach, which could benefit Visa as a leading payment processor.

- Stock Technical Analysis: Visa shares are currently priced at $326.01, trading 4% below the 20-day and 4.2% below the 100-day simple moving averages, indicating a bearish trend in the short term, prompting investors to watch the upcoming earnings report for future performance insights.

- Optimistic Earnings Outlook: Visa's earnings report on January 29 is expected to show an EPS of $3.14 (up 14.18% YoY) and revenue of $10.69 billion (up 12.39% YoY), with analysts generally rating the stock as a

Continue Reading

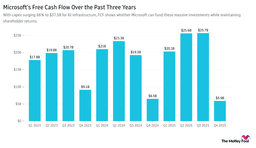

Microsoft Shares Drop as Spending Surges

- Microsoft Performance Decline: Microsoft (MSFT) shares fell over 5% in pre-market trading due to disappointing quarterly results, despite a 39% growth in Azure cloud revenue and a 66% increase in capital expenditures, highlighting a tension between significant AI investments and market concerns.

- AI Investment Confidence: CEO Satya Nadella reassured investors that Microsoft's AI business has surpassed some major franchises, indicating strong future growth potential, especially as cloud orders exceed capacity, despite fears of an AI bubble.

- Mineral Stocks Drop: Stocks like MP Materials and United States Antimony Corp fell nearly 10% in early trading after the U.S. government walked back plans to guarantee minimum prices for critical minerals, reflecting a negative impact on market confidence due to policy shifts.

- Consumer Spending Shift: Tractor Supply (TSCO) dropped over 5% after reporting results below expectations, citing a shift in consumer spending as net income remained flat year-over-year, indicating pressure on the retail sector from the current economic environment.

Continue Reading