Amkor Technology Q4 Earnings Exceed Expectations

Written by Emily J. Thompson, Senior Investment Analyst

Updated: 1h ago

0mins

Should l Buy AMKR?

Source: seekingalpha

- Strong Performance: Amkor Technology reported a Q4 GAAP EPS of $0.69, beating expectations by $0.25, indicating robust performance in the semiconductor packaging sector and reinforcing its market position.

- Revenue Growth: The company achieved $1.89 billion in revenue for Q4, a 16% year-over-year increase that surpassed market expectations by $50 million, reflecting sustained demand for its products and boosting investor confidence.

- Positive Guidance: Amkor anticipates Q1 2026 net sales between $1.60 billion and $1.70 billion, exceeding the consensus estimate of $1.54 billion, showcasing the company's optimistic outlook for future growth.

- Capital Expenditure Plans: The company plans to invest approximately $2.5 billion to $3.0 billion in capital expenditures for the full year 2026, highlighting its commitment to technology upgrades and capacity expansion to capitalize on growth opportunities in the semiconductor industry.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy AMKR?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on AMKR

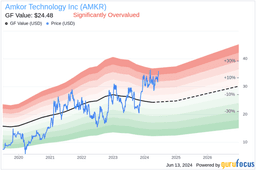

Wall Street analysts forecast AMKR stock price to fall over the next 12 months. According to Wall Street analysts, the average 1-year price target for AMKR is 42.14 USD with a low forecast of 28.00 USD and a high forecast of 62.00 USD. However, analyst price targets are subjective and often lag stock prices, so investors should focus on the objective reasons behind analyst rating changes, which better reflect the company's fundamentals.

9 Analyst Rating

4 Buy

5 Hold

0 Sell

Moderate Buy

Current: 49.360

Low

28.00

Averages

42.14

High

62.00

Current: 49.360

Low

28.00

Averages

42.14

High

62.00

About AMKR

Amkor Technology, Inc. is a provider of outsourced semiconductor packaging and test services. The Company is engaged in the outsourcing of semiconductor packaging and test services. It designs and develops packaging and tests technologies focused on advanced packaging solutions, including artificial intelligence. Its packaging and test services are designed to meet application and chip-specific requirements, including: the required type of interconnect technology; size; thickness; electrical, mechanical, and thermal performance. It provides turnkey packaging and test services including semiconductor wafer bump, wafer probe, wafer back-grind, package design, packaging, system-level and final test and drop shipment services. The Company offers services to integrated device manufacturers (IDMs), fabless semiconductor companies, original equipment manufacturers (OEMs) and contract foundries. It allows IDMs to outsource packaging and test services and focus their investments.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Earnings Release Date: Amkor Technology is set to release its Q4 earnings after the market closes on February 9, with analysts expecting earnings per share to reach 44 cents, an increase from 43 cents in the same period last year, indicating sustained improvement in profitability.

- Revenue Growth Expectations: Analysts project Amkor's quarterly revenue to hit $1.84 billion, up from $1.63 billion a year earlier, reflecting the company's positive performance amid recovering market demand.

- Stock Performance: Amkor's shares surged 11.5% to close at $49.36 last Friday, suggesting a bullish market sentiment ahead of the earnings report, which may further boost investor confidence.

- Analyst Rating Insights: Benzinga provides access to the latest analyst ratings, allowing investors to gauge Amkor's market performance and future potential, thereby aiding in more informed investment decisions.

See More

- Strong Quarterly Performance: Amkor Technology reported earnings per share of 69 cents, surpassing the market expectation of 44 cents by 56.11%, indicating robust performance in the semiconductor sector.

- Revenue Exceeds Expectations: The quarterly revenue reached $1.89 billion, exceeding Wall Street's estimate of $1.84 billion, reflecting ongoing growth in advanced packaging and computing segments.

- Optimistic Future Outlook: Amkor expects first-quarter GAAP EPS to range between 18 cents and 28 cents, above the analyst estimate of 21 cents, with revenue projected between $1.6 billion and $1.7 billion, showcasing confidence in future performance.

- Stock Price Surge: According to Benzinga Pro, Amkor Technology's stock rose 3.01% to $54.10 in Monday's extended trading, reflecting positive market sentiment towards its earnings report.

See More

- Strong Performance: Amkor Technology reported a Q4 GAAP EPS of $0.69, beating expectations by $0.25, indicating robust performance in the semiconductor packaging sector and reinforcing its market position.

- Revenue Growth: The company achieved $1.89 billion in revenue for Q4, a 16% year-over-year increase that surpassed market expectations by $50 million, reflecting sustained demand for its products and boosting investor confidence.

- Positive Guidance: Amkor anticipates Q1 2026 net sales between $1.60 billion and $1.70 billion, exceeding the consensus estimate of $1.54 billion, showcasing the company's optimistic outlook for future growth.

- Capital Expenditure Plans: The company plans to invest approximately $2.5 billion to $3.0 billion in capital expenditures for the full year 2026, highlighting its commitment to technology upgrades and capacity expansion to capitalize on growth opportunities in the semiconductor industry.

See More

- Earnings Schedule: This week features a high volume of earnings reports from technology, consumer discretionary, and energy sectors, with RIVN stock showing notable movement ahead of its earnings release, indicating investor sentiment.

- Monday.com and Pagaya Reports: On Monday, work management SaaS provider Monday.com and fintech company Pagaya released their earnings before the market opened, with expectations that their results will reflect broader industry trends.

- Coinbase Earnings Expectations: On Thursday, Coinbase is expected to report earnings of 68 cents per share and quarterly revenue of $1.86 billion, despite facing a projected 33% drop in transaction revenue, raising investor interest in its growing stablecoin and subscription services.

- Nebius Group Forecast: Also on Thursday, Nebius Group is projected to report a loss of $1.14 per share and revenue of $246.05 million, with analysts expressing caution, reflecting concerns over cloud service demand in the current market environment.

See More

- Earnings Announcement Date: Amkor Technology is set to release its Q4 earnings on February 9th after market close, with consensus EPS estimated at $0.44 and revenue expected to reach $1.84 billion, reflecting a 12.9% year-over-year growth, which could significantly impact the company's stock performance.

- Performance Expectation Analysis: Over the past two years, Amkor has beaten EPS and revenue estimates 63% of the time, indicating a stable performance in the market, and this upcoming report is expected to further solidify its competitive position in the semiconductor packaging sector.

- Estimate Revision Dynamics: In the last three months, EPS estimates have seen one upward revision with no downward adjustments, while revenue estimates have experienced three upward revisions, suggesting increased market confidence in Amkor's future performance, potentially attracting more investor interest.

- Market Reaction Expectations: Despite Amkor's solid fundamentals, UBS has downgraded its rating, indicating a cautious market stance on the balance of risk and reward, which may influence short-term investor decisions.

See More

- Stock Purchase Overview: On January 5, 2026, Mullin disclosed purchases of 10 stocks, each ranging from $15,000 to $50,000, indicating his ongoing interest in small and mid-cap stocks, with most having market capitalizations below $20 billion.

- Small-Cap Characteristics: Notably, two of these stocks have market caps under $5 billion, reinforcing Mullin's preference for smaller stocks, which could influence his decisions on the Armed Services Committee, particularly regarding future government contracts.

- Historical Trade Review: Prior to this, on December 29, 2025, Mullin bought six of the Magnificent Seven stocks, investing at least $50,000, highlighting his preference for tech stocks, with Microsoft Corp (MSFT) being the largest investment.

- Potential Conflict of Interest: Given Mullin's role on the Armed Services Committee, Benzinga will closely monitor his future stock trades, especially concerning potential conflicts arising from military actions in countries like Venezuela.

See More