Smartsheet Inc. (NYSE: SMAR) Reports Third Quarter Fiscal 2025 Financial Results

Smartsheet Inc., the AI-enhanced enterprise-grade work management platform, has announced its financial results for the third fiscal quarter ending October 31, 2024.

Key Financial Metrics

| Metric | Q3 FY2025 | Q3 FY2024 | YoY Growth |

|---|---|---|---|

| Total Revenue | $286.9 million | $245.3 million | 17% |

| Subscription Revenue | $273.7 million | $231.9 million | 18% |

| Professional Services Revenue | $13.2 million | $13.5 million | (2)% |

| GAAP Operating Loss | $(3.4) million | $(35.5) million | N/A |

| Non-GAAP Operating Income | $56.4 million | $19.4 million | N/A |

| GAAP Net Income (Loss) | $1.3 million | $(32.4) million | N/A |

| Non-GAAP Net Income | $61.0 million | $22.6 million | N/A |

| Operating Cash Flow | $63.5 million | $15.1 million | N/A |

| Free Cash Flow | $61.8 million | $11.4 million | N/A |

Smartsheet's financial performance shows a strong year-over-year growth in total revenue, driven particularly by a robust increase in subscription revenue. The company has notably improved its profitability, turning a significant prior-year GAAP net loss into a modest net income.

Revenue Breakdown by Segment

| Segment | Revenue | YoY Change |

|---|---|---|

| Subscription Revenue | $273.7 million | 18% |

| Professional Services Revenue | $13.2 million | (2)% |

The company’s subscription segment continues to see strong demand, reflecting the value of Smartsheet’s enhanced work management platform. The slight decline in professional services revenue could suggest a focus on enhancing self-sufficiency within their platforms.

Key Developments and Operational Highlights

- Announced a definitive agreement to be acquired by Blackstone and Vista Equity Partners in an all-cash transaction valued at approximately $8.4 billion.

- Successfully hosted the U.S. ENGAGE customer conference for the second consecutive year.

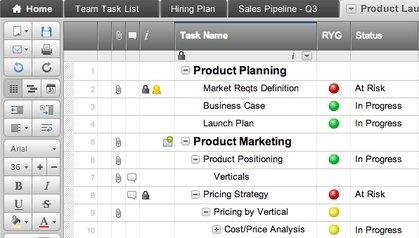

- Launched a new user experience with first-of-a-kind features.

- Introduced a Smartsheet connector for Amazon Q Business.

Executive Comments

Company executives highlighted the strategic acquisition agreement and emphasized ongoing innovations in product offerings. They also noted the stable increase in their customer base and recurring revenue metrics as key indicators of the company's forward momentum.

Forward Guidance

Due to the pending acquisition, Smartsheet did not provide any financial guidance for future quarters.

In conclusion, Smartsheet Inc. has demonstrated solid financial and operational performance in the third quarter of Fiscal 2025, bolstered by strong gains in subscription revenue and an improvement in operating income. The acquisition by Blackstone and Vista Equity Partners marks a pivotal moment in its corporate journey.

For more in-depth analysis and insights, stay tuned with our platform to stay ahead of the market.